One of India’s largest Non-banking financial company – SK Finance Ltd with a track record of 27 years in the financial sector wanted a major overhaul in its turnaround time for customer onboarding.

SK Finance was using a traditional loan disbursement process which was lengthy and time-consuming. With limited coordination in managing sales and no real-time visibility, SK Finance Ltd’s operation was heavily dependent upon manual processes which in turn resulted in higher customer onboarding TAT during customer onboarding.

Challenges Faced By SK Finance Ltd –

- Reducing the customer onboarding TAT (Turnaround time)

- Analyzing large amounts of data to generate relevant insights and actions

- Accessing real-time data from the ground and getting real-time visibility

Time-Consuming Customer Onboarding Process (Higher customer onboarding TAT)

The main concern was that the implementation of the traditional loan disbursing process was a very time-consuming and lengthy process. As part of the traditional onboarding process, there is a multitude of processes across various departments like credit, legal, technical, and operations. Moreover, loan disbursal is an extremely tedious operation that costs a lot of time, money, and resources. The whole workflow, starting from sales reps going out to the field till the loan is disbursed, costs SK Finance a lot of time and money.

Due to manually handled processes, the lead-to-conversion ratio is very low, thus resulting in less productivity and low business. There was a direct increase in cost as more time was required to collect and transfer customer documents. The manual verification process not only resulted in time lost for the sales team but also increased the customer onboarding TAT (turn around time) and thus leading to reduced customer satisfaction.

When Toolyt Came into Play…

When SK Finance Ltd implemented Toolyt into their workflow, the result was instant. The lending organization was able to speed up the entire lead-to-sale journey by automating tasks and bringing in the majority of decisions to the front end.

Thus, with the help of Toolyt, the solutions such as credit check, KYC validation, lead management, profiling, etc all could be done in one platform.

Thus, the entire lead management process is controlled with workflows, there was a reduction in errors in comparison to the manual process.

And, with the features such as mobile number verification through OTP and other features like OCR, PDF creator, etc the team is saving a lot of time and effort collecting the data and onboarding. All the paper-related costs were reduced all at once.

Hence, the loan disbursement process is fast, seamless, and hassle-free.

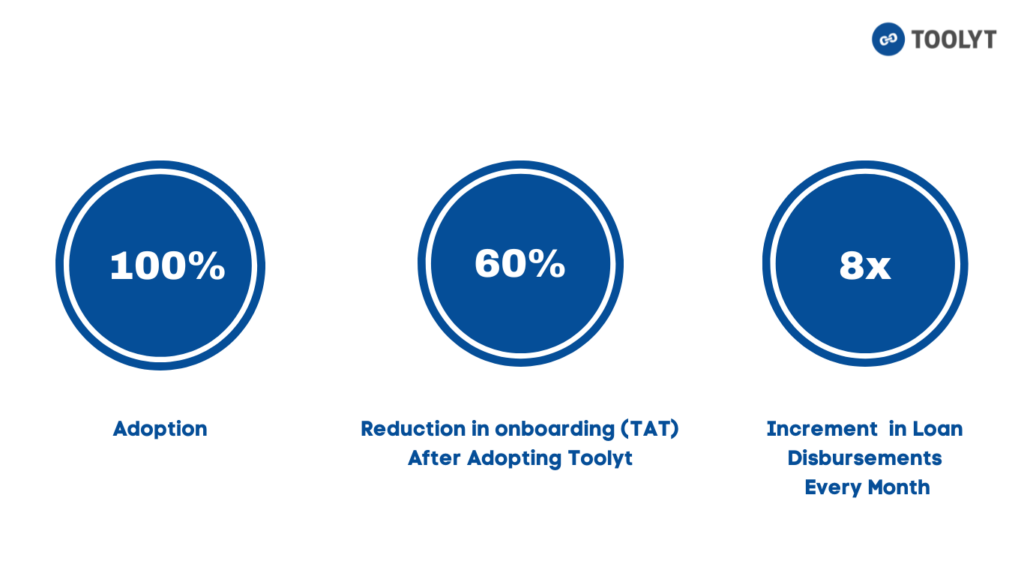

Results After Adopting Toolyt = Reduction in customer onboarding TAT

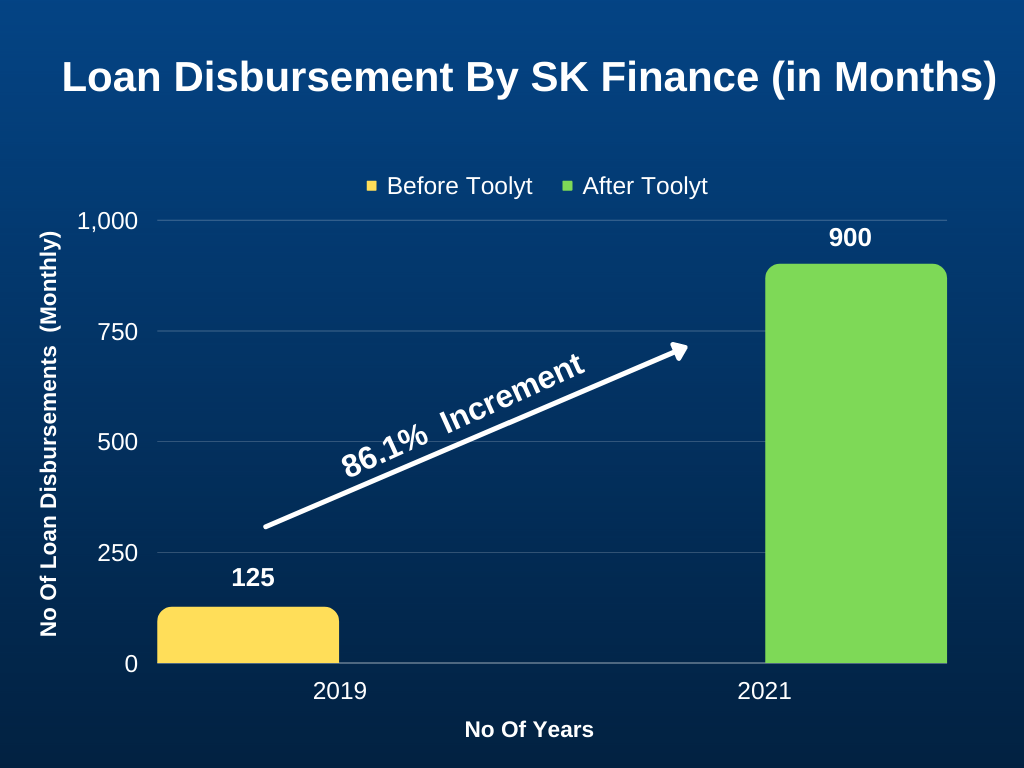

- In the above graph, we can see “Loan Disbursement By SK Finance in a month”. Before implementing mobile- CRM Toolyt in 2019, the average loan disbursement per month by NBFC was 125 loans.

- After implementing Toolyt mobile CRM in 2019, the loan disbursement increased drastically. There was an 86.1% increment in loan disbursements since 2019, the average loan disbursements increased to 900+ loans per month in the year 2021.

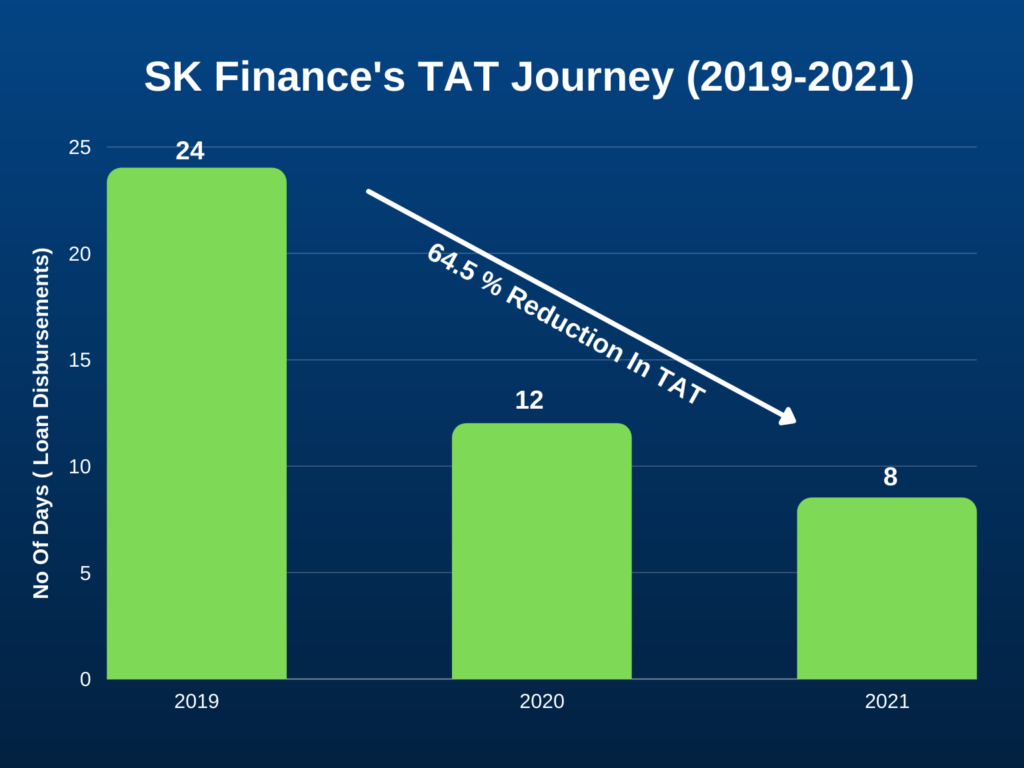

- “SK Finance’s customer onboarding TAT journey (2019-2021)” – The graph represents the customer onboarding TAT ( Turn around time) of SK Finance Ltd for every loan disbursement. In the year 2019, on average – SK finance was onboarding customers in 24+ days with a manual loan disbursement process.

- After the implementation of mobile CRM Toolyt, the customer onboarding TAT reduced drastically. The following year 2020, customer onboarding TAT was reduced to 12 days and in 2021, it decreased further to 8 days.

Want the same results?

Schedule a Demo now!