Request trial.

Switch to auto-pilot

Unlock the potential of your field sales team by enabling them to execute the perfect sales process. To get started, either select a convenient time using our calendar or simply provide your email address, and we’ll set up a trial account for you.

Experience Toolyt and Discover How You Can:

1. Automate Workflows: Streamline processes and eliminate dependencies for a seamless lead management experience.

2. Enhance Collaboration: Empower your team to work together effectively from anywhere.

3. Improve Efficiency: Reduce turnaround time (TAT) and elevate customer experience.

Please Note: Toolyt might not be suitable for every industry or use case. We will review your request and respond as soon as possible. If you are an existing customer experiencing technical issues, please contact us at support@toolyt.com, and we’ll get back to you promptly.

Explore 'Pulse'

Insights, news and updates

Stay informed and inspired: discover the freshest articles and latest updates

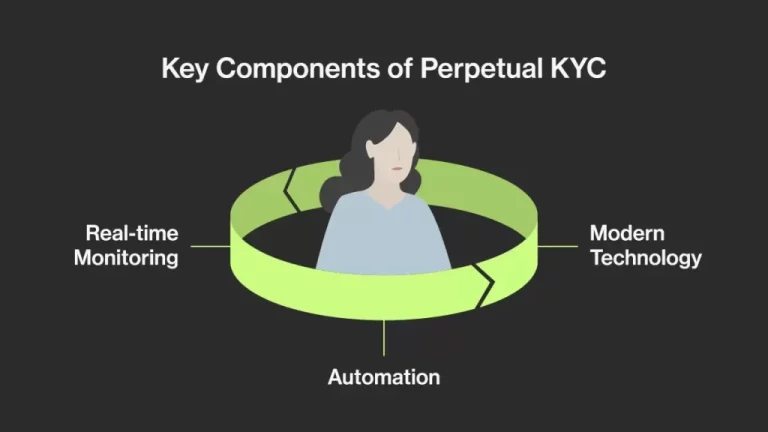

Perpetual KYC: Transforming Compliance and Customer Experience in Financial Services

Discover how Perpetual KYC revolutionizes compliance, risk management, and customer experience through continuous monitoring and advanced technologies.

Choosing the Right Business Rule Engine for Your Lending Business: A Comprehensive Guide

A Business Rule Engine (BRE) plays a crucial role in automating complex decisions and workflows, particularly in lending where precision and speed are paramount.

Understanding FOIR: A Key Metric for Loan Approval in Lending

FOIR remains one of the most crucial ratios for lenders in assessing borrower eligibility. By offering a clear view of how much of a borrower’s income is tied to existing debt, it helps lenders mitigate risks and ensure borrowers can handle their loan obligations

Latest Regulatory and Growth Updates in India’s NBFC and Lending Sector

The Non-Banking Financial Company (NBFC) sector in India, a vital player in lending and financial services, is currently undergoing significant regulatory scrutiny and facing challenges that are reshaping its landscape. Here are some of the key updates:

Detailed Analysis and Findings on Unified Lending Interface (ULI)

The Unified Lending Interface (ULI) represents a significant advancement in the Indian lending landscape, with the potential to reshape how credit is accessed and disbursed.

Digital Disruption in Banking: The Decline of Clerical Roles and the Rise of Tech-Savvy Workforce

According to a study by the Reserve Bank of India (RBI), the workforce distribution between officers and support staff has changed dramatically over the past decade. In FY11, the ratio of officers to support staff, including clerks, was 50:50. However, by FY23, this ratio had shifted to 74:26