Cloud-based & Mobile-first Lending CRM

Integrating with India Stack, our Lending CRM digitizes loan and lending processes, enhancing innovation and security.

-

ISO 27001

-

SOC2 Type 2

-

Compliance with RBI

-

2FA & Access Control

Streamline Your Lending Process

Smart Lead Management for Financial Institutions

Easily generate and assign leads by branch, loan amount, or product type using our Lending CRM. Use KYC OCR for real-time validation and seamless form integration. Toolyt optimizes customer interactions, lead scoring, and deduplication for efficient lending operations.

Efficient, Accurate, and Fraud-Free Lending

Streamlined KYC, eSign, and Onboarding via mobile

Securely collect bank statements and account details through OTP verification using Lending CRM. Generate CIBIL scores and connect with BRE to reduce onboarding time, improve accuracy, and minimize fraud. Also integrated with eSign, eNACH, etc., for easy onboarding.

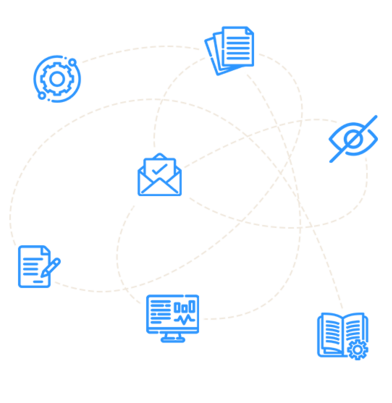

Reduce Turnaround Time

Efficient Collaboration and Escalation

Toolyt Lending CRM enhances efficiency with features that enable seamless collaboration, automatic deviations, and escalations for unresolved cases. Multiple teams can work simultaneously on cases, reducing dependencies by collecting documents digitally via the Document Management Module with an easy-to-use PDF creator.

Optimize Payment Collection

Streamlined Collection and Recovery

Toolyt integrates seamlessly with your loan management system to generate daily collection details and assign tasks to the right team members. With e-NACH (both physical and UPI) integration, our Lending CRM facilitates automatic payment collection via mobile. For overdue payments, Toolyt allows for cash collection or secure payment link generation through a payment gateway.

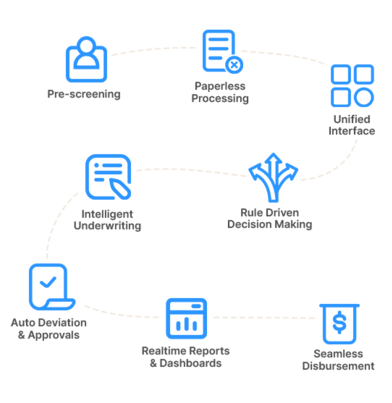

Digitize Lending Process at Every Step

Make all your processes such as lead management, document collection, validations, deviations etc. within mobile to reduce turnaround time and improve data quality.

TAT Reduction

User Adoption

Lead Wastage

From application to disbursal

Toolyt streamlines every loan journey.

Our Lending CRM platform enables risk assessment by gathering data from multiple sources, facilitating faster approvals and reducing risk. Ensure an efficient and organized loan application process.