Understanding FOIR: A Key Metric for Loan Approval in Lending

The Fixed Obligation to Income Ratio (FOIR) is a critical metric for evaluating loan eligibility. FOIR calculates the percentage of a borrower’s income dedicated to servicing existing debts, like EMIs and credit card payments. Understanding how FOIR works is crucial for lending professionals to assess financial health and mitigate risks.

What is FOIR?

FOIR represents the portion of a borrower’s gross monthly income spent on fixed obligations. These obligations include:

• Existing loan EMIs

• Credit card dues

• Rent payments (if applicable)

• Any other recurring debt or commitments that must be paid monthlyLenders typically view FOIR as an indicator of a borrower’s capacity to take on additional loans. A lower FOIR indicates that a person has more disposable income left after paying off debts, making them more likely to handle additional financial burdens.

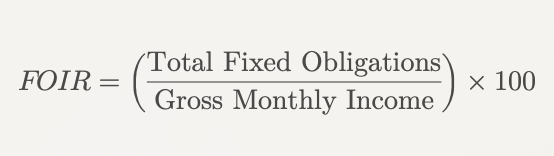

How is FOIR Calculated?

The formula for FOIR is straightforward:

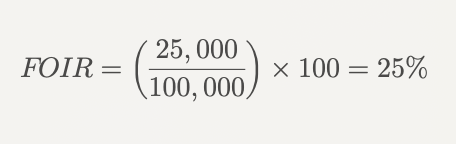

For example, if a borrower has total fixed obligations of INR 25,000 and a gross monthly income of INR 100,000, their FOIR would be:

This means 25% of the borrower’s income is allocated to fixed obligations, leaving them with 75% to manage other expenses and potentially service a new loan.

Ideal FOIR for Lending

Lenders generally prefer a FOIR below 40-50%. This range suggests that a borrower has enough disposable income to comfortably manage additional loan repayments. A higher FOIR, especially one exceeding 50%, indicates that the borrower is already burdened with significant debt. This poses a risk for default, as there may be insufficient income left to cover new loan repayments.

FOIR’s Role in Loan Eligibility

When assessing a loan application, lenders not only evaluate the applicant’s credit score but also their FOIR. This is because even a borrower with a high credit score could still have a high FOIR, making them more likely to default due to limited cash flow. In contrast, a lower FOIR indicates a higher likelihood of successful loan repayment, improving approval chances.

For different loan types, the ideal FOIR varies:

• Home Loans: Lenders usually accept a higher FOIR for home loans, often up to 50%. This is because home loans are long-term and involve significant amounts of money. However, the borrower’s repayment capacity is still assessed closely.

• Personal Loans: For personal loans, the acceptable FOIR is generally lower, often capped at 40%. Since these loans are unsecured, lenders demand more assurance that the borrower can manage their finances well.Improving FOIR to Increase Loan Eligibility

For lending professionals, it is vital to help borrowers understand how they can improve their FOIR:

* Reducing Debt: One of the quickest ways to lower FOIR is by paying off existing loans and reducing debt obligations.

* Increasing Income: If possible, increasing one’s income can bring down the FOIR percentage, as the borrower will have a higher gross income to offset their fixed obligations.

* Consolidating Debt: Borrowers can also consider consolidating high-interest loans into lower-interest ones, thus reducing their monthly outflow.

* Restructuring Loan Terms: Extending the tenure of an existing loan can lower monthly EMIs, reducing the FOIR and making the borrower more eligible for new credit.FOIR vs. Other Ratios

While FOIR is crucial, it’s not the only metric lenders use to gauge financial health. Others include:

* Debt-to-Income Ratio (DTI): While similar to FOIR, DTI includes all debt obligations, including those not fixed (like utilities or other bills).

* Loan-to-Value Ratio (LTV): This ratio measures the loan amount relative to the asset’s value, primarily used in secured loans like mortgages.For lending professionals, understanding how FOIR interacts with these other ratios can offer a comprehensive view of a borrower’s financial standing.

Conclusion

FOIR remains one of the most crucial ratios for lenders in assessing borrower eligibility. By offering a clear view of how much of a borrower’s income is tied to existing debt, it helps lenders mitigate risks and ensure borrowers can handle their loan obligations. For lending professionals, focusing on the FOIR, alongside other metrics like DTI and LTV, can lead to more informed, balanced lending decisions.