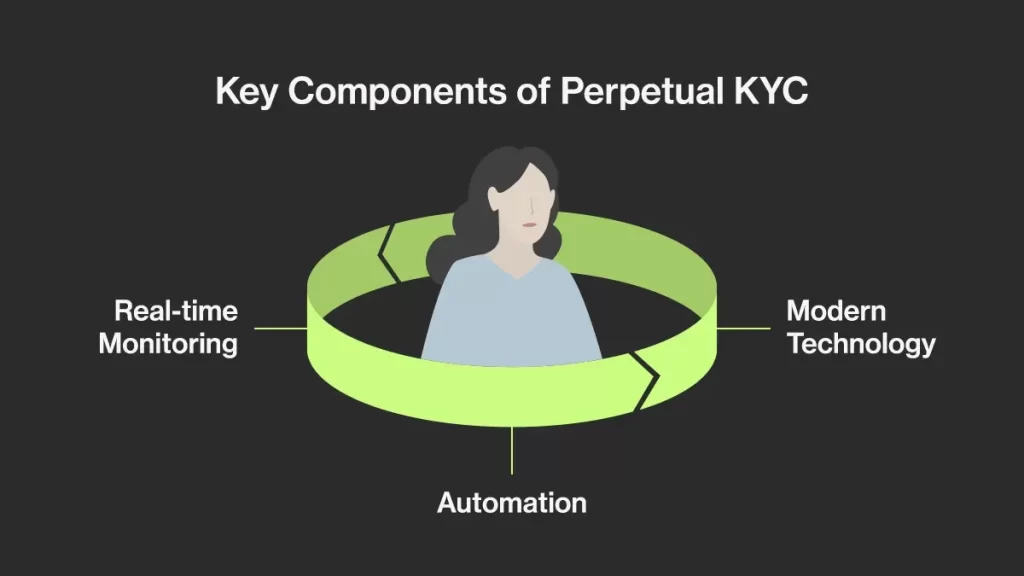

Discover how Perpetual KYC revolutionizes compliance, risk management, and customer experience through continuous monitoring and advanced technologies.

Choosing the Right Business Rule Engine for Your Lending Business: A Comprehensive Guide

A Business Rule Engine (BRE) plays a crucial role in automating complex decisions and workflows, particularly in lending where precision and speed are paramount.

Understanding FOIR: A Key Metric for Loan Approval in Lending

FOIR remains one of the most crucial ratios for lenders in assessing borrower eligibility. By offering a clear view of how much of a borrower’s income is tied to existing debt, it helps lenders mitigate risks and ensure borrowers can handle their loan obligations

Latest Regulatory and Growth Updates in India’s NBFC and Lending Sector

The Non-Banking Financial Company (NBFC) sector in India, a vital player in lending and financial services, is currently undergoing significant regulatory scrutiny and facing challenges that are reshaping its landscape. Here are some of the key updates:

Detailed Analysis and Findings on Unified Lending Interface (ULI)

The Unified Lending Interface (ULI) represents a significant advancement in the Indian lending landscape, with the potential to reshape how credit is accessed and disbursed.

Digital Disruption in Banking: The Decline of Clerical Roles and the Rise of Tech-Savvy Workforce

According to a study by the Reserve Bank of India (RBI), the workforce distribution between officers and support staff has changed dramatically over the past decade. In FY11, the ratio of officers to support staff, including clerks, was 50:50. However, by FY23, this ratio had shifted to 74:26

RBI’s New Guidelines on Credit Information Reporting: Key Highlights

The Reserve Bank of India (RBI) has introduced a new directive requiring all credit institutions to report credit information to Credit Information Companies (CICs) on a fortnightly basis, starting from January 1, 2025. This change from the previous monthly reporting requirement aims to enhance the accuracy and timeliness of Credit Information Reports (CIRs), which are crucial for lenders to make informed credit decisions.

RBI’s New Repository: A Crucial Step Towards Regulating Digital Lending Apps and Protecting Consumers

The Reserve Bank of India (RBI) has recently announced plans to establish a public repository of digital lending apps (DLAs) as part of its efforts to regulate the rapidly growing digital lending sector. This initiative is intended to tackle the increasing issues posed by unauthorized and fraudulent lending platforms. The repository will serve as a […]

The Importance of Lead Scoring in the Financial Industry

Lead scoring is a method used to rank prospects based on their potential value to a business. This process involves assigning scores to leads based on predefined criteria, such as demographics, behavior, and engagement.

A Study on Essential Features for Mobile Loan Origination Solutions

Loan origination is a complex process that involves multiple stages, from application submission to approval and disbursement. With the advent of mobile technology, financial institutions have the opportunity to make this process more efficient and user-friendly. However, selecting an appropriate mobile solution requires careful consideration of various features that ensure compliance, security, and a seamless user experience.