Perpetual KYC: Transforming Compliance and Customer Experience in Financial Services

In the dynamic financial landscape, traditional Know Your Customer (KYC) processes are increasingly challenged by sophisticated financial crimes and stringent regulatory demands. Financial institutions are recognizing the limitations of periodic KYC reviews and are shifting towards Perpetual KYC (pKYC) to enhance compliance and risk management.

Understanding Perpetual KYC (pKYC)

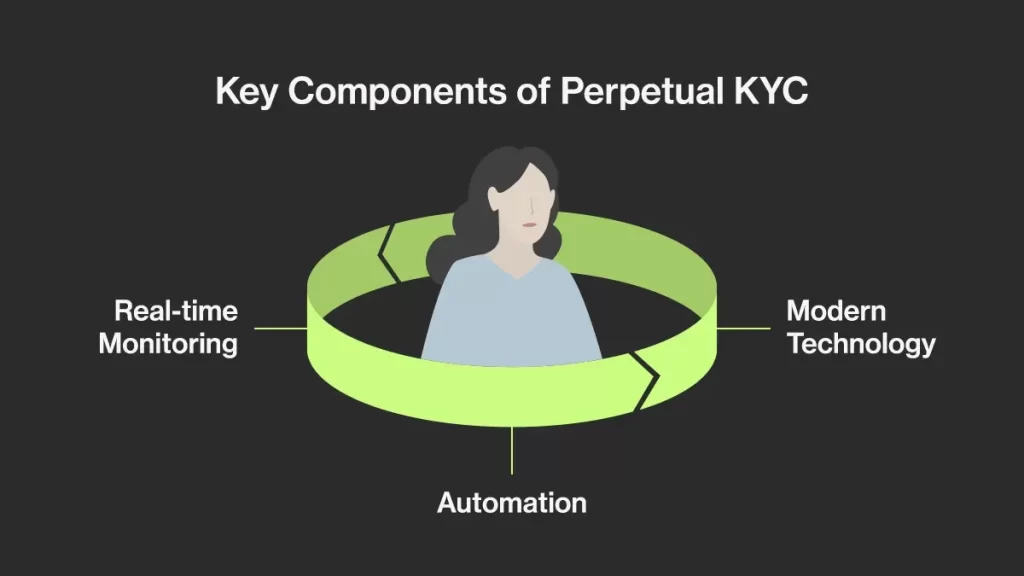

Perpetual KYC represents a paradigm shift from static, periodic customer verification to a dynamic, continuous monitoring model. Unlike traditional KYC, which involves verifying customer identities at specific intervals, pKYC entails real-time updates of customer information, ensuring that data remains current and accurate. This proactive approach enables financial institutions to promptly detect and address changes in customer profiles, thereby mitigating risks associated with outdated information.

Advantages of Implementing pKYC

- Enhanced Risk Management: Continuous monitoring allows for immediate detection of suspicious activities, significantly reducing the risk of fraud, identity theft, and money laundering.

- Operational Efficiency: Automation of the KYC process reduces manual efforts, allowing financial institutions to allocate resources more effectively and focus on core business activities.

- Improved Customer Experience: By reducing the need for repetitive information requests, pKYC streamlines customer interactions, leading to higher satisfaction and loyalty.

- Regulatory Compliance: pKYC ensures adherence to evolving regulatory requirements by maintaining up-to-date customer data, thereby minimizing the risk of non-compliance penalties.

Challenges in Adopting pKYC

Transitioning to a pKYC model presents several challenges:

- Data Management: Effectively handling vast amounts of continuously changing customer data requires robust data management systems.

- Integration with Existing Systems: Implementing pKYC may require significant changes to existing systems and processes, which can be complex and resource-intensive.

- Regulatory Compliance: Financial institutions must ensure that their perpetual KYC processes comply with applicable laws and guidelines as regulations evolve.

Best Practices for Implementing pKYC

To effectively integrate pKYC into compliance frameworks, financial institutions should consider the following strategies:

- Develop a Comprehensive Strategy: Before implementing perpetual KYC, financial institutions should develop a comprehensive strategy outlining the project’s objectives, scope, and timeline.

- Leverage Advanced Technologies: Utilize automation tools and data analytics to enhance the efficiency and accuracy of the KYC process.

- Monitor Regulatory Changes: Stay current with evolving regulations and ensure that perpetual KYC due diligence processes comply with applicable laws and guidelines.

- Measure and Optimize Results: Continuously monitor and measure the effectiveness of pKYC processes and make adjustments as needed to optimize performance and results.

The Role of Technology in pKYC

Advanced technologies, including artificial intelligence and machine learning, are pivotal in automating and enhancing pKYC processes. These technologies enable real-time monitoring and analysis of customer data, facilitating prompt detection of suspicious activities and ensuring compliance with regulatory requirements.

Conclusion

Embracing Perpetual KYC is essential for financial institutions aiming to strengthen compliance, enhance risk management, and deliver superior customer experiences. By adopting a proactive, technology-driven approach, institutions can navigate the complexities of modern financial ecosystems and maintain a competitive edge.